Estate & Retirement Planning

We have unique tools for helping our clients reduce or even eliminate taxes during retirement. We have two distinct programs we utilize. Our first program is what we call our Zero Tax Roadmap. Our second program is a copyrighted irrevocable trust with unique features.

Zero Tax Roadmap can help you be confident about your retirement savings strategies. You may be able to safely recover misdirected assets and reallocate them to a plan designed to help maximize growth potential, while minimizing risk and increasing the amount you receive in retirement.

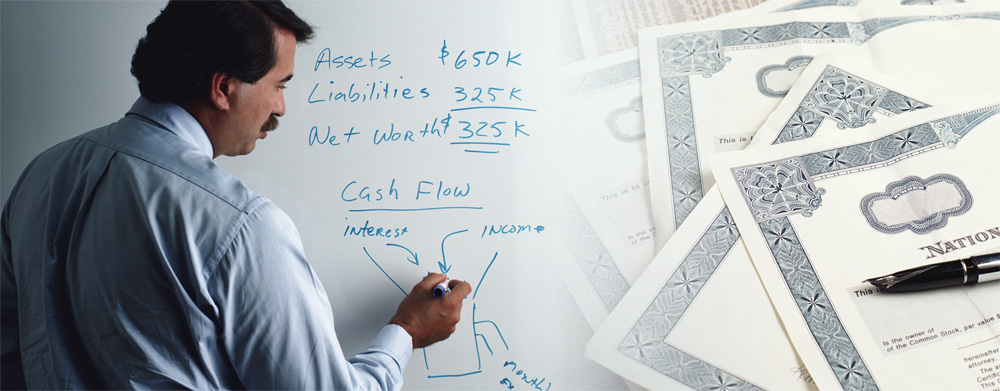

The Zero Tax Roadmap is a step-by-step asset shifting guide that can help you get full mileage from your assets, while minimizing risk, under the current tax code. You’ll learn to take charge of your retirement savings through tools like a private pension plan, Index Universal Life Insurance, Roth IRA’s, and modifications to overall investment planning. We use precise calculations to gradually re-position your taxable, tax deferred, and tax-free savings to help bring you as close to a Zero Tax retirement as we can possibly achieve. Even if taxes double but you’ve followed our Roadmap, the amount you get won’t change.

Clyde Cleveland, President, and Karey Rebello, CPA, CFP discuss the Zero Tax Strategy

Important Disclosures and Terms of Use

HOME | ABOUT US | ANNUITIES | ESTATE & RETIREMENT PLANNING

ASSET MANAGEMENT | CONTACT US