Why annuities?

Annuities have been around for centuries, actually since the Roman Empire. They have been used as a savings vehicle, and primarily as a way to provide a lifetime guaranteed income. About 20 years ago the first indexed annuities came on the market and they have become, by far, the most popular form of annuity. The primary attraction is the potential for a higher rate of return than the traditional fixed annuity.

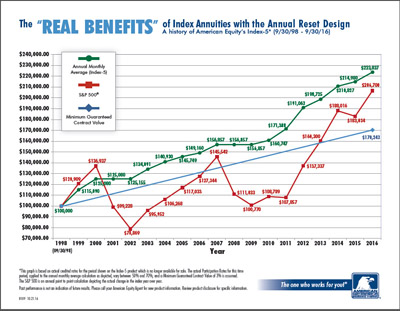

The graph below shows the difference between three different investments. The stock market, an indexed annuity, and a Bank Certificate of Deposit As you can see from the graph, the green line, which is the indexed annuity has performed extremely well. The fact that the indexed annuity has never had a negative year, but has been able to participate in a portion of the market gains, has made it, over the long term, an attractive investment option.

Click HERE for a larger version of this graph.

Clearly, the most attractive benefits of indexed annuities is that there is no loss of principal because of stock market declines.

Clyde Cleveland, President, and Karey Rebello, CPA, CFP

discuss the advantages of indexed annuities

Important Disclosures and Terms of Use

HOME | ABOUT US | ANNUITIES | ESTATE & RETIREMENT PLANNING

ASSET MANAGEMENT | CONTACT US